In India, the concept of jewellery as heirlooms is ingrained in our antiquity. Jewels are regarded as generational wealth which are passed on from generation to generation. With the advent of uncut diamonds adorning celebrity photoshoots and high-profile weddings, the growing popularity of these rough gems can’t be overlooked.

As the name implies, an uncut diamond is a diamond in its unaltered state. This type of gem is a raw diamond that is fully virgin and untouched by human manipulation. This diamond does not go through any process to enhance its proportion, symmetry, and polish, which are typically involved in diamond cutting.

Prerna Rajpal, Founder, Amaris by Prerna Rajpal, throws light on how these uncut diamonds deserve special admiration for their appearance and can be regarded as family treasures. “I think the heirloom value of uncut diamonds is something which even diamond studded jewellery can’t match up with. These beautiful pieces can be passed on between generations,” she says.

The unmatched aesthetics of uncut (also known as polki) diamonds come with a price to match. They’re valued quite high; sometimes even higher than traditional diamonds. But does the high-cost imply a high return value of these gems? “While they are cherished for their aesthetic appeal, it is essential to recognise that the investment value of uncut or polki diamonds rarely extends beyond their beauty,” says Mohit Jethani of JetGems.

Vandana M Jagwani, Creative Director of Mahesh Notandass Fine Jewellery and Founder of Vandals seconds Jethani’s opinion. “Uncut diamonds are primarily purchased for their aesthetic value, and the return on investment is dependent on supply and demand.”

Along with polki gems, the introduction of lab-grown diamonds also hailed a new era for the jewellery industry, many years ago, offering consumers more choice. Except for the fact that they are developed in a lab, lab-grown diamonds can’t be told apart from natural ones. They display the same fire, scintillation, and glitter as mined diamonds and share the same chemical, physical, and optical characteristics as well. “Lab grown diamonds have existed for many years now in different shapes and forms. It was always American diamonds or zircons (erstwhile technology to grow these diamonds). As the technology got better, we have moved to moissanite. These lab grown diamonds look very similar to real diamonds,” says Rajpal.

But has the accelerated demand and supply of these “bred” diamonds affected the value of natural diamonds?

As per Jethani, “The arrival of lab-made diamonds has undoubtedly expanded the diamond market and offered consumers more choices. However, the investment value of natural diamonds remains intact. Lab-made diamonds have their place, especially for those seeking an ethical and eco-friendly alternative, but they do not possess the same allure and rarity as natural diamonds. As such, the uniqueness, rarity and desirability of natural diamonds are factors that contribute to their investment value.”

Interestingly, both these type of diamonds have their own clientele. The rarity of natural diamonds is justified by their higher prices, however. Jagwani of Notandass points out that due to the paucity of real diamonds, their prices have increased by 20-30 per cent in the last few years.

When speaking of jewellery as an investment, there isn’t much that still compares to the value of the yellow, precious metal, though.

Gold has been an intrinsic part of our culture; as per a recent report, Indian women hold 11 per cent of the world’s gold reserves. At a familial level, gold has always been considered as a worthy investment, even though, over the years, diamond jewellery has become a natural choice for its aesthetic value.

Speaking to Jethani about the right investment when it comes to jewellery, he says, “From an investment perspective, gold jewellery has historically been a secure and lucrative choice. Gold is a timeless metal with a strong cultural significance in India, making it a trusted store of value over generations. Its stability and potential for appreciation have made it a cornerstone of many investment portfolios.

As per Rajpal, diamond jewellery is also a great choice if one’s looking purely from an investment lens. In addition, she recommends opting for certified solitaires, which are IGI (International Gemological Institute) & GIA (Gemological Institute of America) certified, and can be traded anywhere across the world.

In addition to gold, Jethani recommends considering round diamond solitaires of larger sizes as a valuable investment option too. “Round diamonds are renowned for their brilliant cut, which maximises their sparkle and allure. Larger size diamonds have historically shown strong market demand and potential for appreciation due to their rarity and captivating beauty. As with all diamonds, it is crucial to prioritise the quality of the stone, including the cut, colour, clarity, and carat weight, to ensure a sound investment.”

Lab-grown diamonds, uncut diamonds or pure gold ornaments; jewellery has a different meaning to each Indian family and household. Whether purchased as an investment or as an adornment, jewellery will always be regarded as precious treasure that holds more than just monetary value to it. An emotional memento of families and their chronicles, its investment value will never be able to match up to the pricelessness of its anecdotal power.

Words by Akanksha Maker.

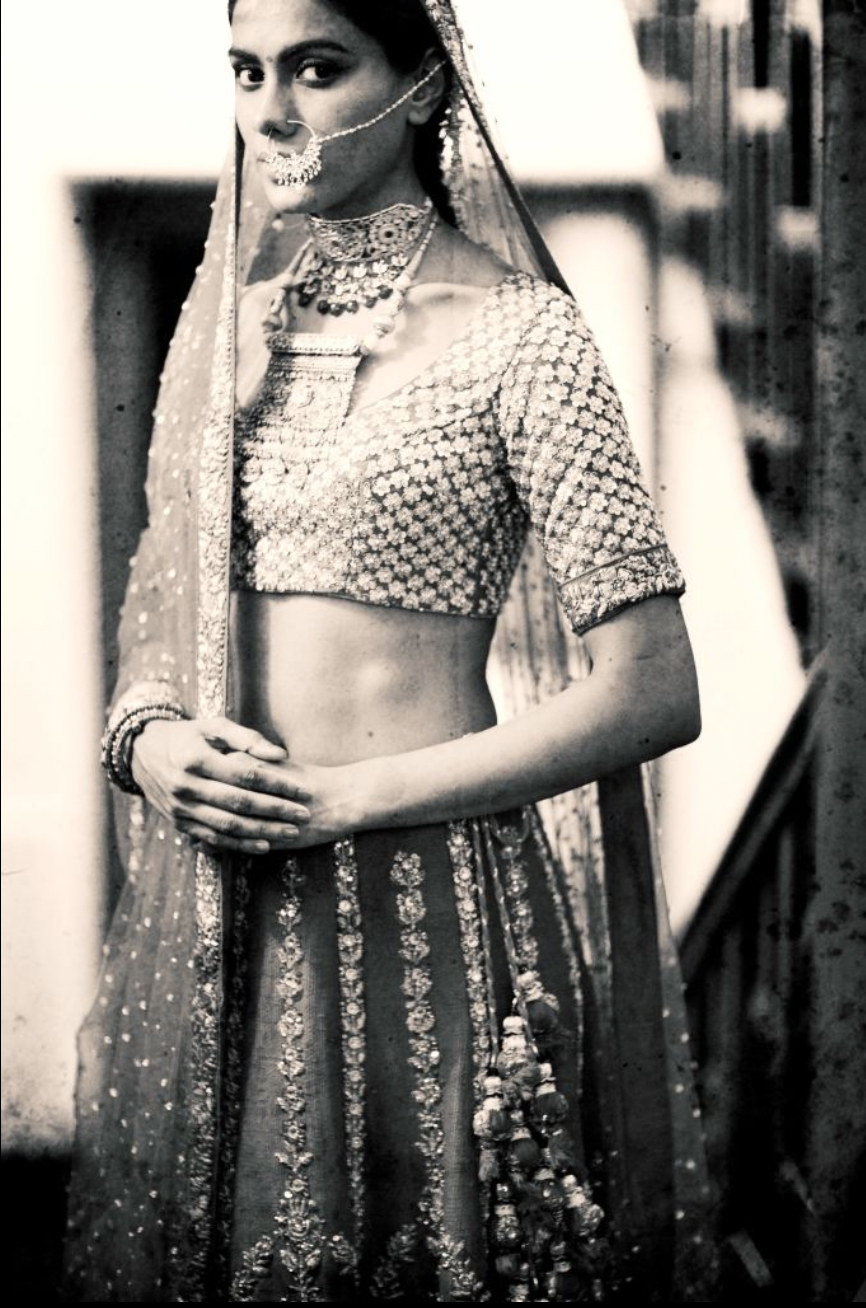

Images Courtesy of House of Pixels with Keshvi Kamdar