It all began with a meme.

In April 2011, a Japanese pop song titled, Nyanyanyanyanyanyanya!, scaled the charts of the most viewed YouTube videos and turned into an overnight internet sensation or as GenZ would like to call it, an internet meme.

This video featured an animated cartoon cat with a Pop-Tart for a torso, running through space, dropping rainbows and leaving behind a trail as it keeps prancing ahead in an infinite loop.

Cut to February 2021: the original .Gif titled Nyan Cat (a shortened title from the name of the song) was sold in an online auction for a whopping value of 300 ETH (the cryptocurrency that powers the Ethereum network). Just for context, at the point of sale, 300 ETH was roughly around ~$600,000 or ~Rs.4,46,60,070.

Now, you must be wondering how in the holy hell of God a.k.a the internet, could a .Gif of an animated cat, dropping rainbows, available for free consumption, make one person so much money?

That’s because it was sold as an NFT.

So, what exactly is an NFT?

NFT stands for Non-Fungible Token which is more like a certificate of authenticity. But before we dive into this phenomenon, one needs to understand what the term ‘fungibility’ actually means.

Fungibility refers to the ability of an asset that can be exchanged or substituted with similar assets of the same value. The simplest example of a fungible asset is currency. Say you have a Rs.2000 note in your wallet but you need change before you choose to step out. You find a kind soul who gives you four notes of Rs.500 in exchange for your Rs.2000. The value of the money you now hold is still Rs.2000, regardless of the fact that now it’s in a different form and/or color.

Non-fungible assets are the opposite. Each token is unique and can be substituted for something similar in nature. Think of any famous painting you know of, let’s say the Mona Lisa at the Louvre – an original piece of art that cannot be bartered with a Mona Lisa drawn by your 6-year old nephew in his art class. Just because it holds great sentimental value, does not mean it can change hands and make you a millionaire overnight. Buyers typically get limited rights to display the digital artwork they represent, but in many ways, they’re just buying bragging rights and an asset they may be able to resell later.

Just like each piece of art bears the signature of the one who created it that eventually authenticates the work as an original, in the world of NFTs that process winds up taking place through Blockchain technology, which records that authentication.

So, NFT is just like any other Cryptocurrency?

NFT is another form of cryptocurrency, but unlike fungible cryptocurrencies like Bitcoin, NFTs are unique. They exist as a string of numbers and letters in the form of data on the Blockchain ledger. Picture a neatly-weaved spider web, where each node represents a piece of vital information – like the owner of the digital asset, the buyer, the time of sale, etc. This data is encrypted, in turn ensuring the authenticity and scarcity of the NFT. This beautifully orchestrated process, with the onset of technology, allows creators to make their creation scarce and secure and therefore more valuable. It also empowers the creator to set their own terms within the creation. One such example is the process of ‘Flipping NFTs’, wherein the creator will receive a percentage of the total value upon each resale of his/her creation. The surface has only been scratched in terms of its true potential.

Making a dent in the universe.

What started as a meme, took over the internet by storm. In 2017, Cryptokitties – a digital collectible game was launched, wherein users were able to buy, trade and breed digital cat collectibles. And there was no looking back.

NFTs have been applied to various domains such as gaming, art and sports collectibles. Case in point: NBA Top shot, which allowed users to procure a collection of digital basketball highlights like a video clip of your favourite dunk. ICC (International Cricket Council) announced a partnership with Faze to create exclusive digital collectibles. Cricket fans across the world can now collect NFTs of some of the most talked-about shots, catches, and wickets from ICC events. Howzzatt?

Elon Musk, poster boy of cryptocurrency, famously known as the DogeDad, turned a tweet on NFT into an NFT. Jack Dorsey, former CEO of Twitter, auctioned the screenshot of his first-ever tweet as an NFT. Back home, Rohit Sharma, captain of the Indian National Cricket team announced his foray into the world of NFTs. The list is endless.

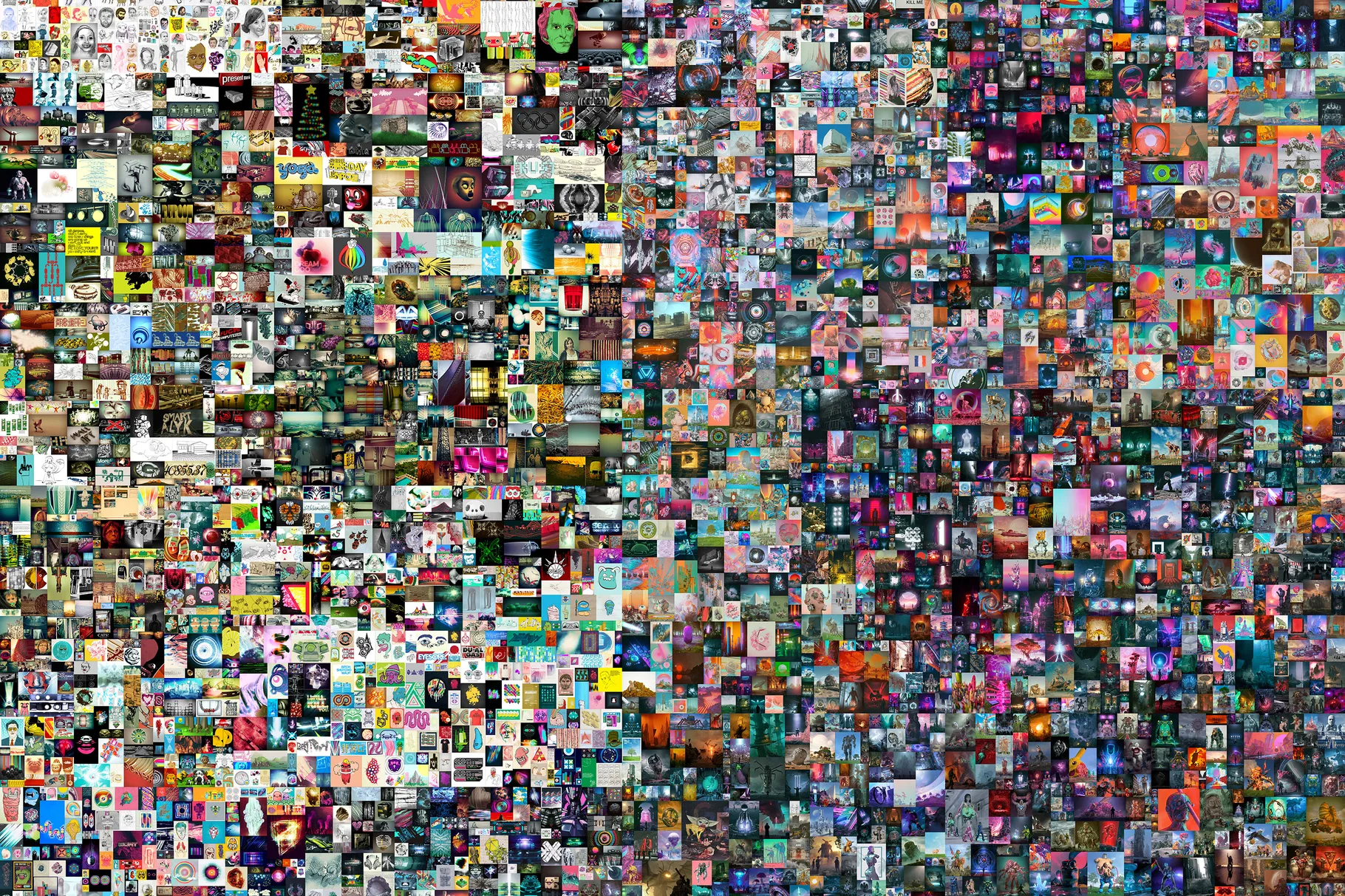

NFTs have waltzed their way into the mainstream art world as well. Auction house Christie’s opened bidding for its first-ever digital art by Mike Winkelman (Beeple), which saw bids from around the world, adding up to a million dollars ($69.3M).

CTRL C + CTRL V

A lot of online marketplaces have observed a glitch in the matrix. Not all NFTs verify the seller of a digital art piece to be the original creator. So the buyer needs to do thorough research to authenticate the purchase or risk losing money, which makes the process quite laborious. Also, the owner of the original artwork cannot restrict others on the internet from copying or changing it before sharing it as their own. Another major criticism comes from the purists who claim that “anything goes” in the name of art is a major disturbance in the balance between class and mass. A cat shitting rainbows, kiddie scribbles, random tweets, or a bloke who has a million selfies – all of them qualify as NFTs.

While there is some substance to the skepticism surrounding NFTs, the optimists are riding the wave with abandon. The NFT market cap which was at ~$41million in 2018 has risen to a mind-boggling ~$40 billion in 2021.

To be continued…

Text by Vivek Bhatia

Cover Artwork by Mike Winkelman (Beeple)