Going once, going twice and SOLD – the enchanting words that make the auction house setting a thrilling experience! Auction houses are a purchasing experience unparalleled to any other for a plethora of reasons. From exclusive curations, exorbitant prices to a sense of rarity- all meld together to create this auction house setting that has stood the test of time and in fact continues to thrive in a world that is being bombarded with e-commerce websites. Auction houses facilitate an environment of exclusivity for the modern consumer who doesn’t wish to conform to the mass production of generic goods.

The business of auctions has existed for aeons longer than one may think, the first recorded auction is said to have happened over 2,500 years ago. Around 500 BC, the Greek historian Herodotus was the first to mention the auction procedure, reporting that it was used in Babylon to sell women for marriage. Thankfully, as the calendar pages changed and society trudged forward on its path of evolution, the birth of modern auctioning took place. Auctions were mentioned in the Oxford English Dictionary for the first time in 1595. In the late 17th century, the London Gazette claimed that artworks were being auctioned at coffeehouses and pubs across the city.

Stockholms Auktionsverk, Sweden

The world’s oldest auction house, Stockholms Auktionsverk, was founded around this time, in 1674 in Sweden. Sotheby’s, the world’s second-largest auction house, held its inaugural auction in 1744. Christie’s, the world’s largest auction house, was founded a few decades later in 1766. This industry has not only generated immense demand for a category of products that cater to a particular niche but over the years these purchases have become a marker of wealth, success and image. Nowadays there are many reasons why collectors are opting to buy from auctions over galleries ranging from access to highly sought-after works, a straightforward buying process and transparency into demand and pricing. Furthermore, many collectors argue that unlike auctions, which are more democratic and open to the public, galleries often function as gatekeepers. Galleries tend to reserve works for a certain list of people before making it available to all to purchase.

Art was seldom looked at as a means of investment however, auction houses rectified that. Not only did these companies validate the effort of the artists and collectors of art, they added immense value to creations that are beyond the naked eyes’ evaluation. When a particular item is selected to be auctioned, an element of exclusivity and rarity envelops it which makes it more desirable for a consumer that is vying for a unique purchase.

Similar to stocks and bonds, art too can increase in value. The logic is simple: if a new artist progresses to have a successful career and gain recognition, the value of their work will simultaneously increase. An Art Basel annual report estimates that the global art market sales reached over $65 billion in 2021. However, investing in art will not produce results in the short term. For one’s monetary investments to bear fruit in the world of art, patience is highly required as experts share that the time window for art to appreciate in value is 10 years or more. However, a huge advantage of art as an asset is that its value does not coincide with the fluctuations of the stock market. The art world is independent of such aspects as each art work is distinct in nature.

SaffronArt Gallery, Mumbai.

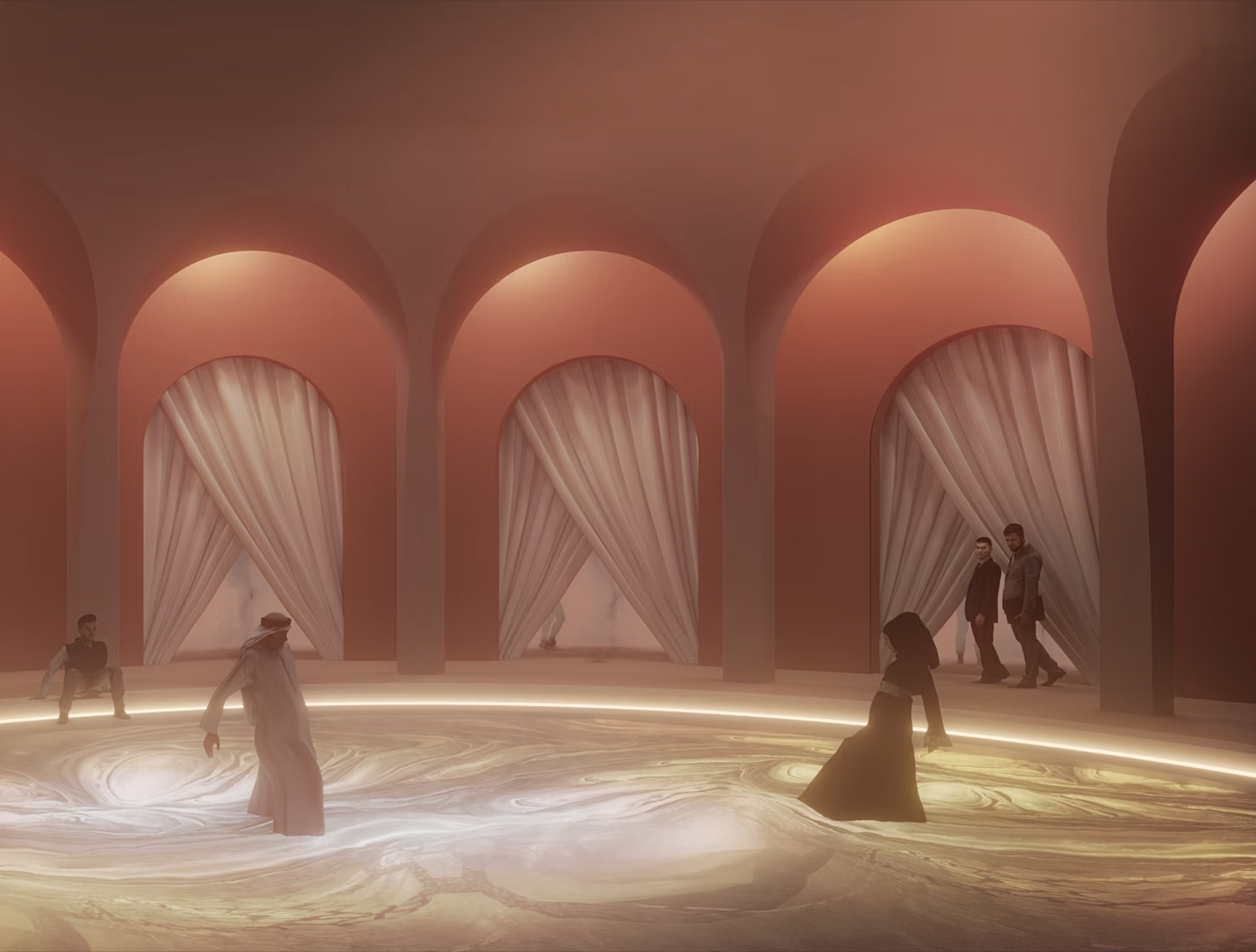

The auction world is fluid and quickly adapts to the evolving demands of the consumer. The global online auction market in 2021 stood at $5.90 billion, and is likely to reach $11.47 billion by 2027. A trend that has increased in recent years is younger audiences that are displaying a keen interest in auctions and willingness to use digital platforms to participate in auctions. High-Net-Worth Millennials have wholly embraced the digital transformation of auctions, and in 2020 were the highest spenders. This is mostly due to the millennials’ transition from being the hardworking, and underpaid generation, in their 20s, to this category’s oldest members approaching their 40s, and have now acquired great purchasing power that they did not have a few years ago.

Although International auction houses have been the front runners in this industry for decades, Indian auction houses are claiming their space increasingly in this space with vigour and passion. From individual value of the artworks to the quality of collections, from the number of buyers to the frequency of auction, Indian art has only been on an upwards trajectory of growth.

Pundole’s Auction House, Mumbai.

The evolution of Indian auction houses has been nothing short of formidable. Companies that are leading the industry in this metamorphosis are SaffronArt, Pundole’s and Asta Guru. However, what seems to set the Indian segment apart from its global contemporaries is the level of intricacy and thorough research involved in curating the auction catalogues.

“There are multiple elements but at the core we focus primarily on the provenance of the artwork. So, we conduct a lot of research on selected art pieces. We go through various mediums of material to identify the art. Once we identify them, then we start the process of figuring out who the current owner of the art is. Essentially, we don’t wait for the art to come to us, we research about what kind of art work we would like to auction and where it could be” shares Siddanth Shetty, V.P. Business Strategy and Operations at Asta Guru in my tête-à-tête with him.

Raja Ravi Varma’s Draupadi Vastraharan, circa 1888-1890.

To establish how Indian auction houses exhibit significant revenue potential SaffronArt shared with us some insights from their record breaking sales. SaffronArt’s Spring live and online auctions which concluded on 6-7 April achieved a combined sales value of INR 115.62 crores. The live auction on 6 April saw a remarkable sale as 89.09% of lots were sold. Record breaking sales were seen with Raja Ravi Varma’s Draupadi Vastraharan, circa 1888-1890, being sold for INR 21.6 crores , making it the second-highest value achieved by the artist in the auction setting globally, while Tyeb Mehta’s Untitled (Bull on Rickshaw), 1999, sold for INR 41.97 crores, making it the highest value achieved by the artist in the auction and the second-most expensive work of Indian art sold globally.

To add to this, Shetty said “Within the calendar year 2021 itself, five auction houses transacting Indian art grossed a combined revenue of INR 845 crores. Of this only 24% i.e. INR 205 crores was revenue posted by overseas legacy auction houses such as Sotheby’s and Christies. The remaining 76% i.e INR 640 crores was clocked by three Indian auction houses – Saffron Art at INR 294 crores revenue, Asta Guru at INR 256 crores revenue and Pundole’s at INR 90 crores revenue.”

Untitled (Still Life with Juxtaposed Forms), F N Souza, 1952.

Truth be told, the way we grew as a company and the industry as well, has only been accelerated due to the pandemic. When the pandemic hit and everyone was stuck in their four walls, people started becoming more conscious of what they were surrounded by. They had the time to explore cultural aspects such as art which they may not have done before. This steadily whet their appetite for acquiring art and since then we have seen an uptick in sales” said Shetty. In accordance to this increase in demand, SaffronArt hosted their annual winter online auction on 14-15 December 2022 with a rich catalogue featuring works by leading Indian modern and contemporary artists.

The sale was led by a rare still life from 1952 by F N Souza. Additional highlights included a monumental work from 2001 by S H Raza, as well as others from important periods in the careers of M V Dhurandhar, Jagdish Swaminathan, Rameshwar Broota, and Manjit Bawa. The catalogue also features sculptures from Meera Mukherjee, Himmat Shah, and others, as well as an extensively unique selection of contemporary artworks.

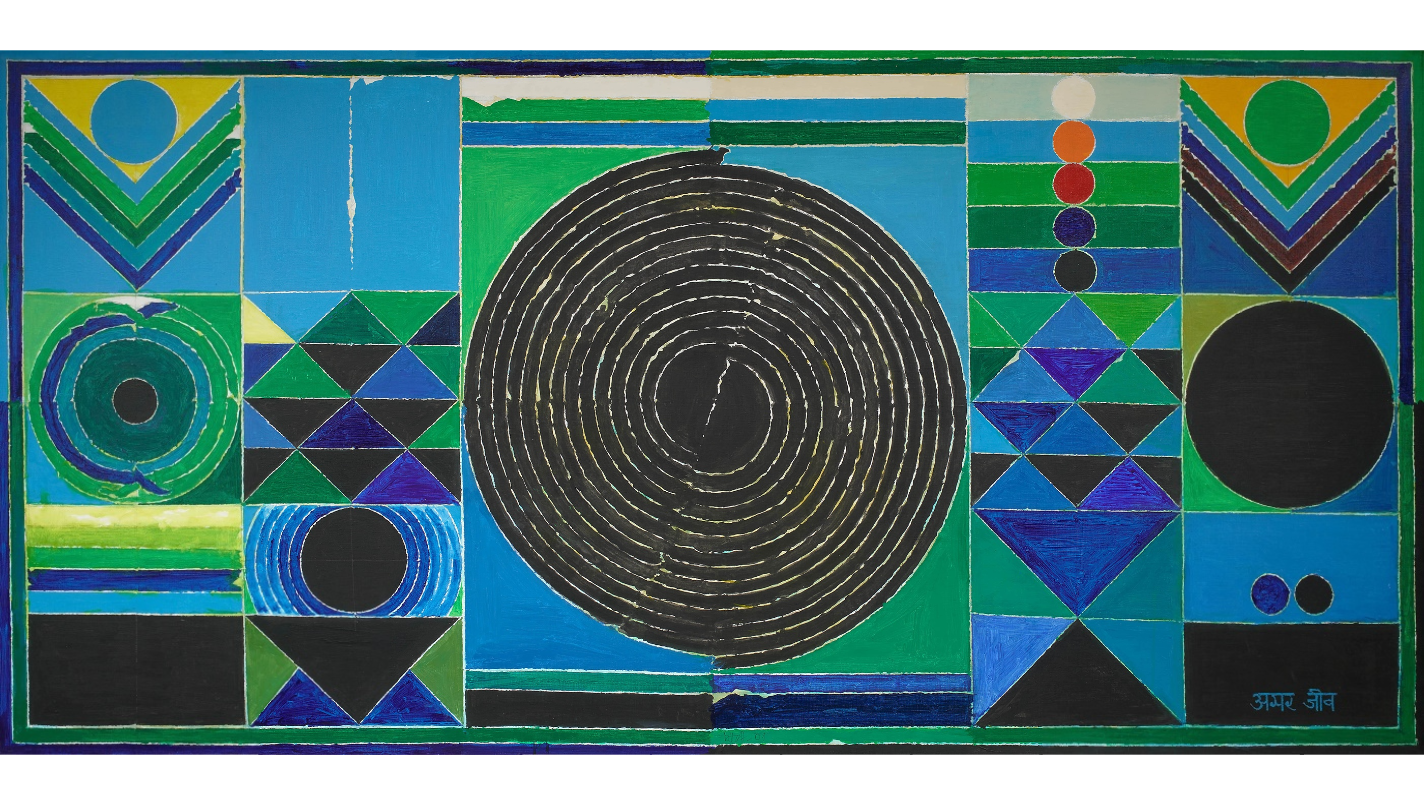

Amar Jiva, S H Raza, 2001.

Over the years, the awareness of India’s inherent cultural depth has grown from strength to strength. The increase in organic demand for Indian art pieces has also spawned the generation of new supply available to be auctioned. In addition, the revenue contribution splits (~74% of Indian art auction revenue) imply that Indian auction houses have upped their game in terms of curation i.e the improved understanding of what pieces move well. This is validated by the higher frequency of sales at an increasing average pricing per item. Thus, a combination of an optimised auction curation and tail winds given create a favourable environment which will help the industry continue its growth momentum going forward.

Words by Anithya Balachandran.

Photographs courtesy of Pundole’s and SaffronArt.